Definitely HYSA over savings for everything. Don’t sell your stocks. Btw are you not investing in an IRA?

I would plan on buying used. New isn’t worth it!

Learn about budgeting, saving, getting out of debt, credit, investing, and retirement planning. Join our community, read the PF Wiki, and get on top of your finances!

Note: This community is not region centric, so if you are posting anything specific to a certain region, kindly specify that in the title (something like [USA], [EU], [AUS] etc.)

Definitely HYSA over savings for everything. Don’t sell your stocks. Btw are you not investing in an IRA?

I would plan on buying used. New isn’t worth it!

"New isn't worth it" depends greatly on what you're buying and where you live. The used car market has changed dramatically over the last 4-5 years. Around here at the low end of the market a 2 year old used car with 30kish miles is only ~15% cheaper than the same car brand new. The new car also comes with the full warranty, frequently some level of free regular service & loaners, not to mention no wear and tear. The days of a car losing 25+% of its value for merely being driven off the lot at sale time are long gone.

Fair point. I got mine 5 years ago so that tracks.

I just finished high school so I haven't gotten around to everything yet. I agree, used, there's barely any fun nenew cars

I'm looking at probably a 350z rn and u said to not sell the stocks, why? I'd probably want that money towards the car. theres a bit over a grand in there

I don’t think you should touch stocks until you retire or need them in an emergency. Compound interest works by time in the market. You having stocks at 18 is awesome! If they’re smart picks and you continue to invest, in 35 years you will be able to retire comfortably. In that line of thinking you should very much open your ROTH IRA and try to max it out every year, though that’s hard. $1,000 compounded annually over 35 years with an interest rate between 5-8% is 5.5-14.8k. It’s worth not touching stocks after purchasing unless your original purchase was risky. Of course $1000 isn’t a ton of money but it’s worth treating money invested like this.

I would find another way to come up with additional money.

Here’s a compound interest website: https://www.investor.gov/financial-tools-calculators/calculators/compound-interest-calculator

If you were to invest $100 per month over 35 years it could be 113-221k. Without that time in the market it would be less than 60k.

I’d follow the rule of thumb for anything less than 5 years, use a HYSA. Mines around 4%, which isn’t beating the market but at least the value will only go up. Something you want for a short term goal like this.

may I ask who you have your account with? really appreciate that chart

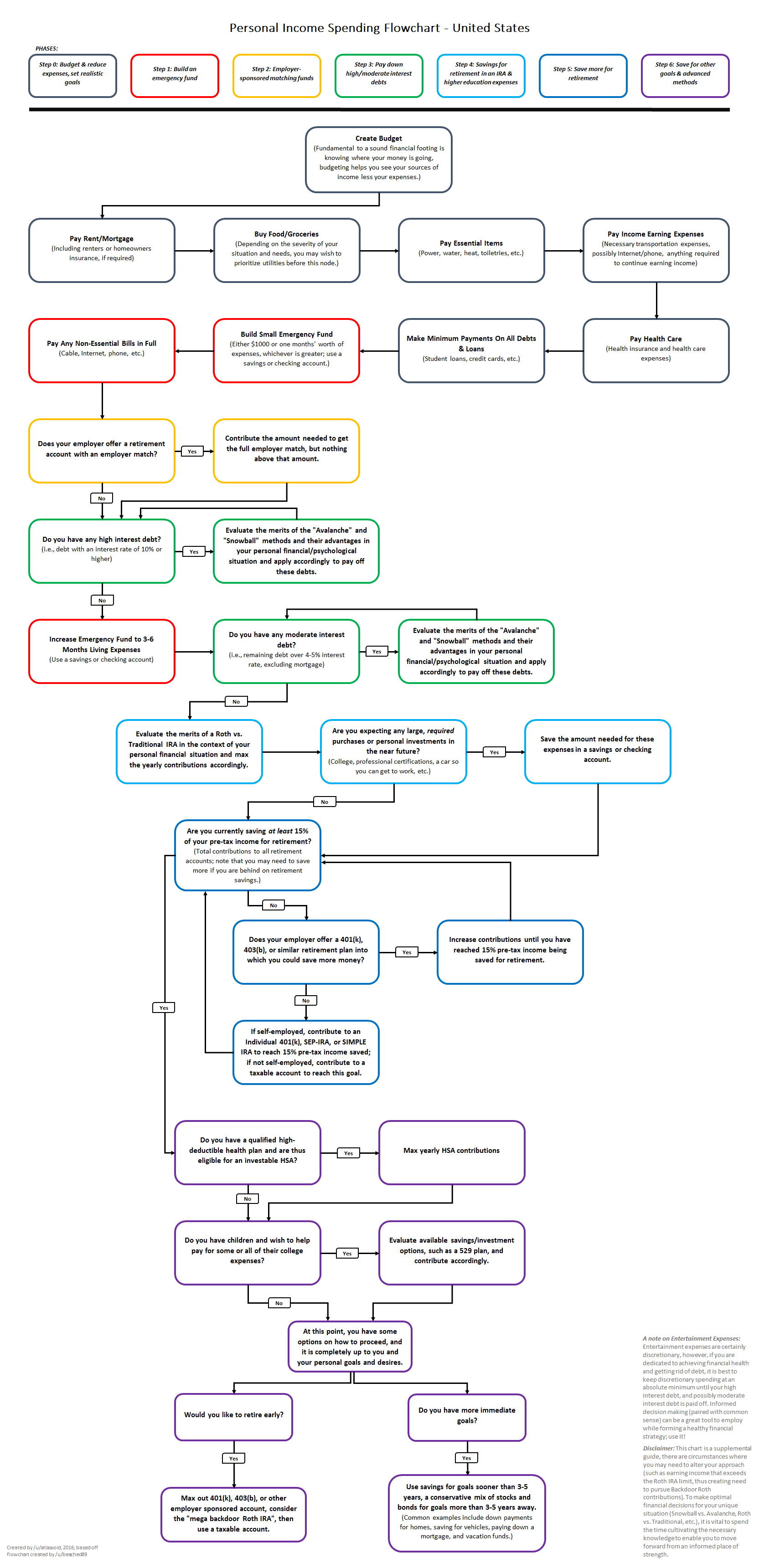

No problem at all. Yoinked from r/personalfinance a while ago.

I’m using Wealthfront :)

High interest saving account for saving up to buy things like this.

It’s slower but the best way to basically guarantee you will have the money available at a future point when you need to buy the car.

SPAXX on fidelity is pretty easy to get into. Just open a Fidelity account and xfer your money there. During high interest it was getting 5% now its about 4% I think. You get paid out every month.

To invest I think it makes more sense if you are holding for 5 years minimum

Check out Wealthfront's "Individual Cash Account" it's a HYSA that makes it really easy to move money in/out of it (including a debit card) and gives you 4.5% APY for a "boostable" amount of time (DM me for a "friend" link that will boost yours and mine). Base APY is 4%. Zero account fees and no minimum balance to earn. They also do free ATM reimbursement, free wire transfers and send/deposit checks. Plus the app has pretty good ratings. I've been really happy with it.