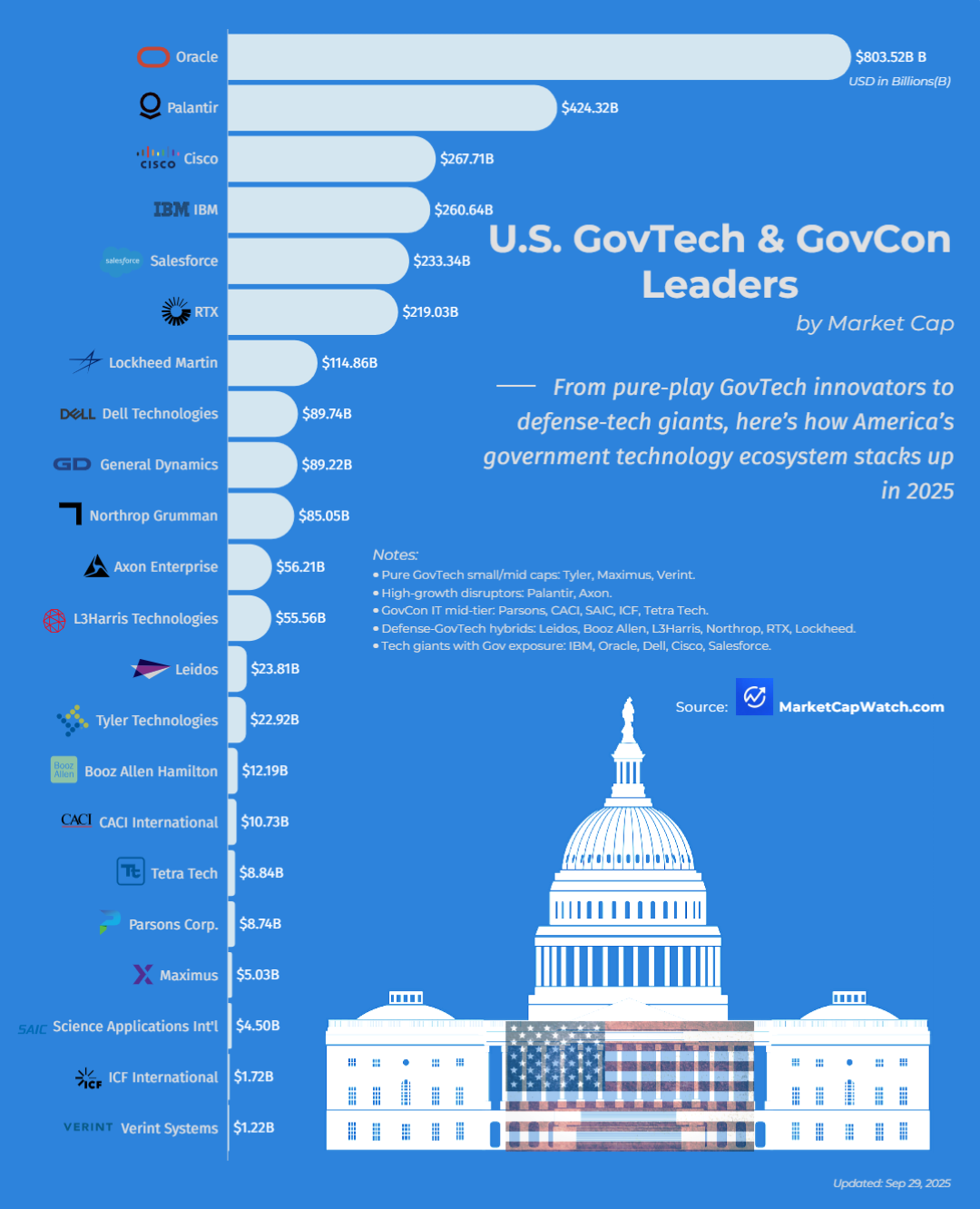

Source: MarketCapWatch

This ranking highlights the financial scale of the companies powering the backbone of artificial intelligence — from GPUs and chips to cloud platforms and enterprise AI. NVIDIA ($4.45T) leads by a wide margin, cementing its role as the compute engine of the AI era. Microsoft ($3.8T), Apple ($3.6T), and Alphabet ($2.9T) follow as hyperscale cloud and platform leaders, while Amazon ($2.3T) and Meta ($1.8T) continue to expand their AI infrastructure footprints.

Beyond the U.S. giants, Tencent ($757B), Alibaba ($355B), Samsung ($430B), and Cambricon ($73B) showcase Asia’s growing role in AI infrastructure. Palantir ($416B) stands out as a specialized AI platform player, while AMD ($349B), Intel ($173B), and Qualcomm ($165B) remain critical in the chip race.

Yes, Walmart is a publicly traded company and its stock (WMT) is listed on the New York Stock Exchange.