Hate to be that guy but Euro what, apples, oranges? You can't join a currency. Did you mean eurozone? You have a degree in journalism right?

Europe

News and information from Europe 🇪🇺

(Current banner: La Mancha, Spain. Feel free to post submissions for banner images.)

Rules (2024-08-30)

- This is an English-language community. Comments should be in English. Posts can link to non-English news sources when providing a full-text translation in the post description. Automated translations are fine, as long as they don't overly distort the content.

- No links to misinformation or commercial advertising. When you post outdated/historic articles, add the year of publication to the post title. Infographics must include a source and a year of creation; if possible, also provide a link to the source.

- Be kind to each other, and argue in good faith. Don't post direct insults nor disrespectful and condescending comments. Don't troll nor incite hatred. Don't look for novel argumentation strategies at Wikipedia's List of fallacies.

- No bigotry, sexism, racism, antisemitism, dehumanization of minorities, or glorification of National Socialism.

- Be the signal, not the noise: Strive to post insightful comments. Add "/s" when you're being sarcastic (and don't use it to break rule no. 3).

- If you link to paywalled information, please provide also a link to a freely available archived version. Alternatively, try to find a different source.

- Light-hearted content, memes, and posts about your European everyday belong in !yurop@lemm.ee. (They're cool, you should subscribe there too!)

- Don't evade bans. If we notice ban evasion, that will result in a permanent ban for all the accounts we can associate with you.

- No posts linking to speculative reporting about ongoing events with unclear backgrounds. Please wait at least 12 hours. (E.g., do not post breathless reporting on an ongoing terror attack.)

(This list may get expanded when necessary.)

We will use some leeway to decide whether to remove a comment.

If need be, there are also bans: 3 days for lighter offenses, 14 days for bigger offenses, and permanent bans for people who don't show any willingness to participate productively. If we think the ban reason is obvious, we may not specifically write to you.

If you want to protest a removal or ban, feel free to write privately to the mods: @federalreverse@feddit.org, @poVoq@slrpnk.net, or @anzo@programming.dev.

Join the Euro please and Denmark too even if you have an opt-out

This is somewhat related:

Sweden says Russia is greatest threat to its security

Russia poses the greatest threat to Sweden due to its aggressive attitude towards the West, the Scandinavian nation's security service Sapo has said.

Another important factor to take into account is the fact that the krona was performing worse when the survey was carried out than it is now ‒ on Sunday, Bloomberg reported that the Swedish krona was the best performing of all 11 G10 currencies, the most traded currencies in the world.

Burying the lead a little bit there. Also worth noting that even then the opinion turned out to be a minority at 32%.

FYI: It's usually "Burying the lede" because the introductory section of the article is spelled "lede", ostensibly to distinguish between the article's leading point (lead) and the thin strip of metal (lead) that was used to separate lines of type in setting machines. Source: Merriam-Webster

(Your spelling isn't strictly wrong, I just figured this might be interesting to some)

It wouldn't be a big change for swedes, just shave of a zero from the prices. They don't even use banknotes or coins often 😋

Kidding a bit, but it would be good if sweden joined the monetary union IMO.

Can't blame them. The Euro is managed quite reasonably. I can't speak for the Swedes but the EU only has to gain from Sweden joining the Eurozone. I've seen people comment here that giving up currency sovereignty is a terrible idea. But what does that mean? To me it simply means that in times of crisis, governments cannot simply order their central banks to print more fiat currency. This doesn't seem like a great long-term policy either.. but then again I'm not a full-time economist.

Feds don’t normally print money. That would be the treasury and they don’t get to choose how much. The feds usually adjust interest rates by buying and selling treasury bonds that they don’t pay for, or I should say pay for with accounts they can adjust their balances as needed, including destroying “money”, to achieve the desired interest rate and slow or speed the economy. A point of interest is that the fed is not a part of the government and isn’t supposed to be influenced by it. I know it’s a lot easier to just say they or the government just print money but there is a lot of nuance. Anyway, that’s not really what the discussion is so have a great day!

I really hope that would happen, and then there would be more pressure on Denmark to join too.

Worth noting that despite this, support is currently only 32%.

Serious question. Why 15 years? Why wait so long?

Not sure if you're being serious or not, but it's not about joining in 15 years, it's that the support is the highest it's been in 15 years.

If my sarcasm-meter is broken, I apologise.

I was serious and I misread that, sorry.

Eurocrisis with the Greek debt crisis and the like happened a bit less then 15 years ago. Right now the situation with Trump and Russia is scary for Swedes, so they are rethinking their position in the world. Also it is not majority.

Giving up currency sovereignity is a terrible idea! That means the government has to "balance" its budget and can't print money to make up for shortfalls, forcing austerity.

The government has to balance the budget anyway, and devaluing your currency is a bit like peeing your pants. It's nice and warm for a bit and then increasingly uncomfortable.

Inflation goes up, you see capital fights because you're not a reliable currency, you increase your national debt, and you instantly make the entire population poorer than their neighbor countries.

So while there are some benefits, most economists argue against it.

I can't say if Sweden going for the Euro is good or bad for Sweden, and there's a paradox in asking people about it, because if the SEK is weak then support goes up, but it's a bad time to join because of the low value, but if the SEK is strong then support goes down, although we'd be in a much position to join.

The government has to balance the budget anyway.

This is neoliberal dogma with bad consequences for the majority. While there are plenty of economists who subscribe to it, there are plenty others who don't. Economics isn't a well proven science and as a result there are giant gaps filled with unproven hypotheses. While the primacy of budget balancing has been promoted by neoliberal economists since the 70s, evidence has been piling up against it for a while.

Given that new money is created every time a private bank gives out a loan, the only real difference between the government having the ability to create new money or not is the difference between whether the government has to seek private capital (and pay interest on it) or not. Therefore removing the ability to print your own currency is simply shifting public policy power to private capital. Most people don't have enough private capital to participate, therefore it's an increase in the political power of a minority upper class including international actors. One result of this is private capital gaining the power to force austerity by not lending money in need, then profiting from that policy by buying up government services and operating them for profit, typically as monopolies. E.g. healthcare, power, water utilities. The demand for profit means price increases which means inflation.

Therefore a responsible government should retain the ability to create its own currency, create it and destroy it by targeting metrics such as inflation and employment, not budget balances.

Money is just a way to make somebody pay. The problem you describe only happens, when a government is bad in using its money. That leads to high debt. If the country controls the currency it borrows in, then a solution is to print a lot of money to pay back the debt. However that comes with inflation, which usually means poor people have to pay for it. Alternativly the country might not pay at all, which would mainly hurt the rich.

One really important other part of that is that private capital is not able to force austerity. If they have it in your country, the government can just tax them.

Disagree on some of the points but I'll only address the need for money printing and forced austerity since those are the only ones I can relatively concisely. I agree on the assessment on who gets hurt by inflation and default.

I'm not sure if you're saying that governments only need to print more money if they're bad with it but I'll address some needs for money printing just in case.

There are plenty of reasons for governments to print money. For example, population growth. Having growing population and the economic expansion that comes with it, without monetary expansion leads to price instability where prices have to fall in order for the same amount of money to be able to buy more clothes and bread made and consumed by the new people. Price instability is a problem (e.g. deflationary spiral) which is why the government prints money and releases it into the economy to compensate for the increased number of people and goods to keep the prices stable. Critically, the government cannot borrow or tax this money from its citizens because that will remove it from the very economy the government is trying to add money in. End herein lies the clue the government cannot borrow or tax money it hasn't printed and spent first. Printing and spending has to appear first or a government has nothing to tax or borrow. This is why a government does not need to borrow or tax in order to spend. A government might choose to borrow or tax for different reasons after printing and spending. E.g. it could tax in order to keep inflation in check. I'm not saying all governments understand that and I'm definitely implying that the ones that use the family budget analogy don't understand how the system works.

One really important other part of that is that private capital is not able to force austerity. If they have it in your country, the government can just tax them.

This is only true under the additional assumption that the government in question is not ideologically or financially subservient to private capital. If it is, as many are, it will choose not to tax, in which case it would be forced to cut spending and/or sell off assets, which is austerity. This process has driven austerity and privatization in many places around the world. It's driven it where I live as well. In Canada, we've sold railways, utilities and highways, among others.

The problem with printing money to keep deflation in check is only a problem, if the central bank does not care about it. So in the case of Sweden joing the Euro, the ECB absolutly print of destroy money to keep inflation in check. If anything the larger region the currency is used in is going to create more stability.

If a government wants to sell assets to its friends, then it can do so. No need for an economic crisis, austerity or the like. Since you mentioned Canada, Canadian National Railway was privatized in 1995, the years before that the economy grew somewhat well.

You're twice addressing whether something is a problem by saying it's only a problem if someone fucks up. Meanwhile I'm not discussing that because it's not interesting. Yes problems can occur when people do the wrong thing. And people can and will do the wrong thing. They'll also do the right thing. I'm discussing the availability of a tool under domestic disposal and what its implications are.

Similarly, I'm not discussing the obvious case of a government's ability of selling to its friends, it's not interesting. I'm discussing the case where the public and its government don't want to do that but are ideologically committed to balancing budgets without creating new money. Canada was in recession in the early 1980s and the early 1990s. Irrespective of that, the Canadian governments that spanned the 1983-2003 period ran on balancing the budget and austerity+privatization to achieve it and they were not considered friends-selling governments. You can read about the economic policies at the time.

What I am saying is that if the economy grows and the it requires more money, then adopting the euro there are two options. Either money flows in from other countries or the European Central Bank raises interest rates. Unlike just adopting another countries currency like say Ecuador the USD, joing the Eurozone wourld mean that Sweden gets a seat on the Gouverning Council of the ECB, which gives them a vote on raising interest rates or other central bank policies.

As for the second point. Between 1983 and 2003 Canadas economy shrank for only a single year. Debt to GDP was at its highest in 1997, so they most certainly did not give a crap about balancing the budget or anything like it. They wanted to sell public assets and needed an excuse to do so. Thats all that is an excuse.

Yes, joining the Eurozone isn't as bad as adopting the USD while not being the US.

I'm just going to leave this here and tap out.

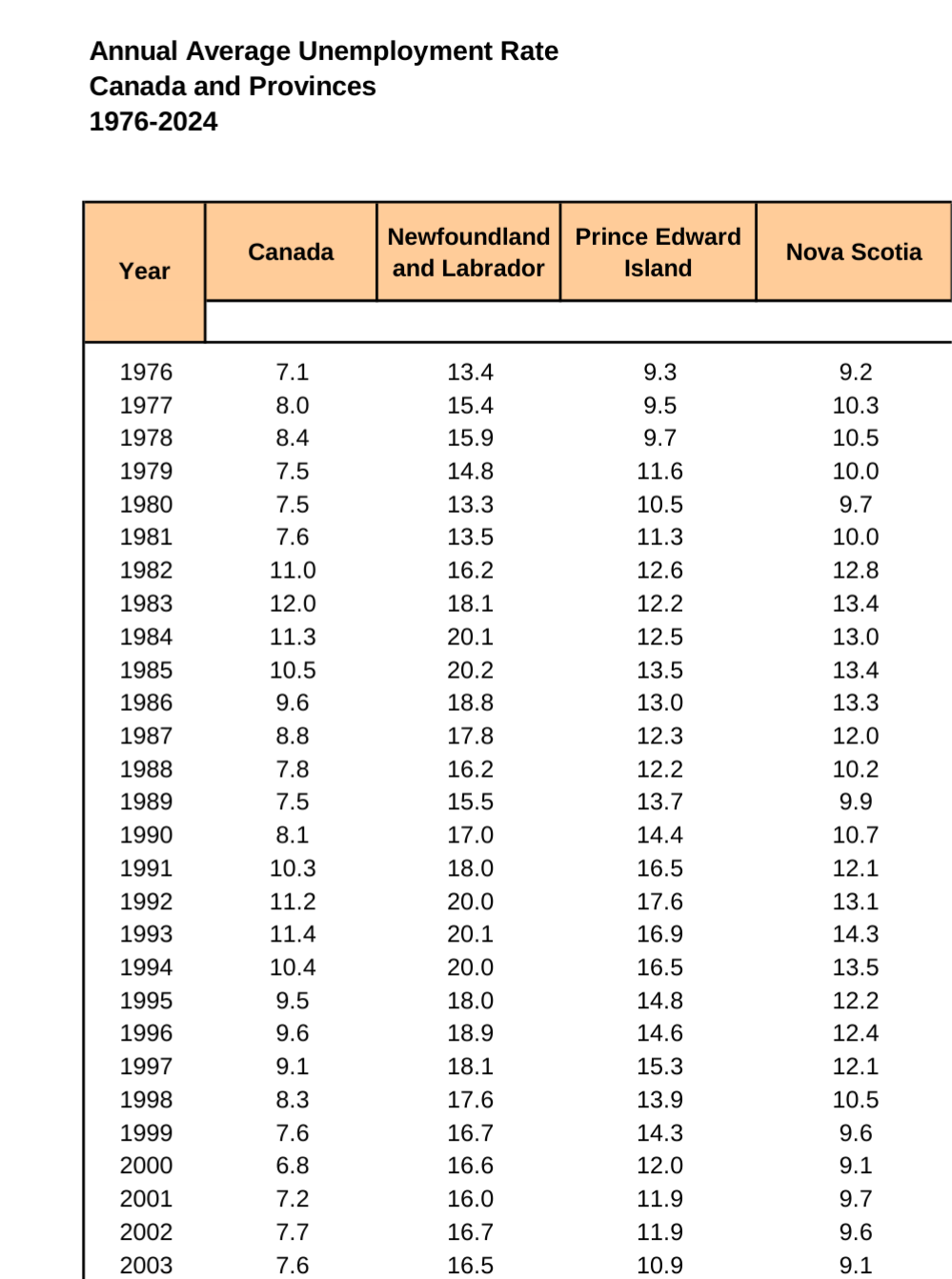

Source: https://stats.gov.nl.ca/Statistics/Topics/labour/PDF/UnempRate.pdf

Sure some have used the opportunity. Large capitalists always use bad times to buy up what they can, private or public. But bad times were most certainly had and they're documented.

By your theory monopolies should be much more common in countries that are already part of the Euro

There are many other variables that affect monopoly density which don't sit frozen. It's why this conclusion doesn't follow from what I said, unless you have a magic wand that can fix them in multiple economies.

Inflation can be controlled. Public spending creates money and taxation destroys it, ensuring the total supply of money doesn't outstrip demand and cause inflaton. Without that sovereignty they can't create or destroy money, they are subject to the whims of the currency bloc.

It's just another tool in the toolbox. Giving it up is foolish.

While that's certainly true, we also had businesses speculate against the Swedish currency in the early 1990s, driving up interest rates to over 500% for a few days in order to stop the outflow of capital.

So there are arguments for adopting the Euro too. But like I said, I'm not informed enough to say which is better. It's a very complex issue.

How is that an argument for adopting the Euro? They stopped the outflow of capital in a couple days, and it's been 30 years. Seems like it worked.

They could do it because we were a small currency, and it it didn't quite work, at least not the way it worked before. The currency is now "floating" against other currencies which it wasn't back then, and we had a recession at the time. I agree that Sweden would be giving up a few tools in the economic toolbox, but on the other hand it gains a few others. I can't say which ones are more valuable because I'm not an economist. I suspect you're not either.

We should be able to have public debate about public policy. My opinion obviously doesn't matter much, but the decision is ultimately in the hands of Sweden's people - not economists.

Public debate is fine. Good even. I wouldn't support a referendum on the Euro though. That would just be another brexit, where lies and falsehoods are spread and a country being split apart. Let the government do an assessment on the benefits and drawbacks and then announce a policy on what they intend to do, and let's see how things turn out in the general election.

And the whims of large domestic and international private capital as the other source of money they can rely on in need.

I agree with you on this, but I guess it should be noted that Sweden has routinely been running at a budget surplus since the 90s, and only recently removed the rule that enforced this, allowing the budget to be exactly balanced.

At a great expense, as this has contributed to underfunding infrastructure and other forms of underinvestment in government-funded services.